High-voltage cable revolution: How do new energy vehicles reshape the global cable industry?

Behind a special cable is the comprehensive upgrade of the wire and cable industry from material science to international competition under the wave of new energy.

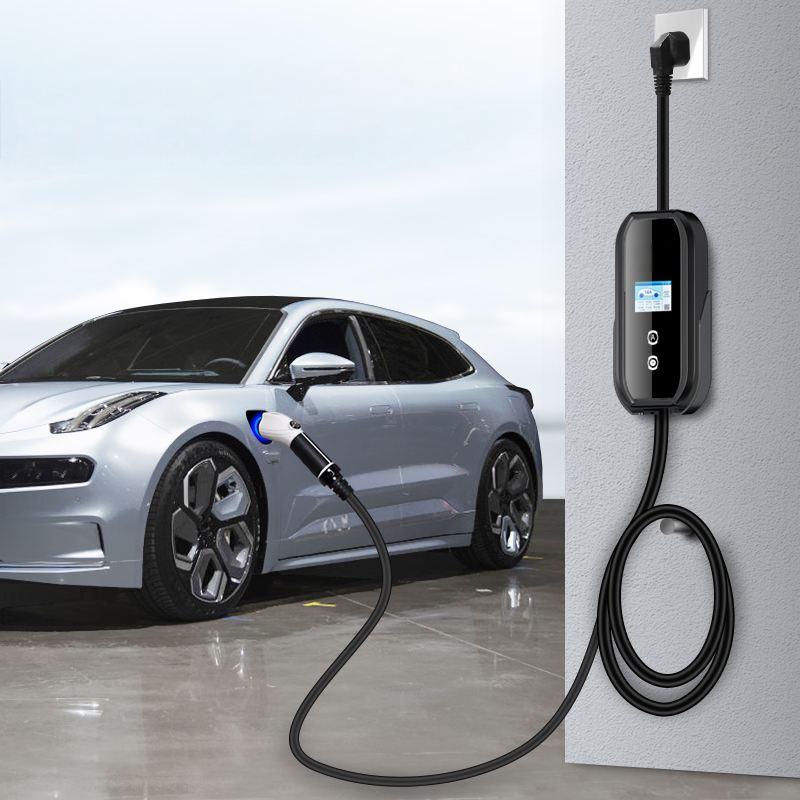

With the 20 millionth new energy vehicle rolling off the assembly line in China, China’s new energy vehicle production and sales have ranked first in the world for eight consecutive years, with a global market share of more than 60%. This transportation energy revolution is profoundly changing an “invisible” industry – wires and cables. New energy vehicle cables are divided into two categories: on-board and off-board. As the “blood vessels” and “nerves” of new energy vehicles, they must not only withstand the high-voltage and high-temperature environment in the car, but also meet the complex and changeable outdoor use needs of charging facilities.

The global electric vehicle charging cable market has reached US$1.54 billion in 2024, and is expected to soar at an annual compound growth rate of 18.6%, exceeding US$14.15 billion by 2037. As the largest new energy vehicle market, China’s new energy vehicle cable market will be about 12.866 billion yuan in 2024, a year-on-year increase of 35.5%. This cable revolution triggered by new energy has just begun.

Market expansion: New energy vehicles give rise to a tsunami of cable demand

The explosive growth of new energy vehicles has directly pushed up the demand for cables. Compared with traditional fuel vehicles, the cable consumption of a single new energy vehicle has increased by more than 30%, mainly from the demand for connecting high-voltage power batteries and motors. The expansion of charging infrastructure has further amplified this demand. The U.S. Infrastructure Act invested $7.5 billion to build 500,000 public charging piles, and China’s new energy vehicle battery replacement project construction volume reached 11 million kilowatts in 2024.

The Asia-Pacific region has become the center of this tsunami, and it is expected to occupy 60% of the global electric vehicle charging cable market by 2037. As the core driving force, more than 35% of new cars sold in China in 2023 are electric vehicles, and India has more than 350 electric vehicle manufacturers.

The market structure of charging cables is also changing dynamically. Straight cables are expected to occupy 60.2% of the market share by 2037 due to their low cost and durability, while AC charging cables will occupy 75.6% of the market share due to their low installation cost and good grid compatibility. The market structure continues to be reshaped under the dual effects of consumer habits and technical economy.

Technological innovation: the dual challenges of high voltage and lightweight

Cables for new energy vehicles face severe technical challenges. High-voltage cables need to withstand voltages above 150V, while meeting high temperature resistance (-40℃ to 180℃), flame retardant, anti-aging and other comprehensive properties. Silicone rubber insulation materials have become the mainstream choice due to their high tear resistance, but high-end materials still rely on imports, and the localization of 180℃ high tear resistance silicone rubber has become the focus of the industry.

Lightweighting has become another technical battlefield. In order to improve the range of electric vehicles, the trend of replacing copper wires with aluminum wires has accelerated, and the proportion of thin-walled wire applications has increased. Flat wire motor technology is rapidly replacing traditional round wire motors in the field of new energy vehicles due to its high space utilization and high power density.

Intelligent networking promotes the upgrading of cable functions. Automotive wiring harnesses have expanded from simple power transmission to high-speed data transmission. The use of coaxial cables and optical cables has increased significantly, and the demand for automotive Ethernet cables has surged. Leading companies such as Leoni and Aptiv have launched composite cables that integrate data and power transmission to meet the needs of vehicle intelligence.

Industrial chain upgrade: From homogeneous competition to special cable breakthrough

China’s cable industry faces structural contradictions: the number of enterprises exceeds 10,000, but the products are highly homogenized, mostly low-end conventional cables, and the production capacity of high-end special cables is insufficient. Driven by the new energy revolution, the industry is undergoing a deep reshuffle, and leading companies with technical reserves are welcoming development opportunities.

Special cables have become a breakthrough direction:

- Photovoltaic cables: Need to withstand ultraviolet rays and high temperatures, East China Cable and other companies have launched special products

- Charging pile cables: Require both weather resistance and flexibility, and the straight design reduces the risk of damage

- Ship cables: Floating cables meet the complementary needs of offshore wind power and photovoltaics

Industry concentration is accelerating. In the first half of 2023, among the 11 cable companies with revenue exceeding 3 billion, Jinbei Electric led with a compound annual growth rate of 31.21%, and its sales of flat magnet wire hit a record high. The trend of resources gathering towards technology leaders is becoming increasingly obvious.

Cost dilemma: the squeeze of raw materials and international trade

Raw material costs constitute the core challenge of the industry. In electric vehicle high-voltage cables, copper accounts for more than 60% of the cost, and price fluctuations of battery materials such as cobalt, nickel, and lithium significantly affect cable pricing. Due to the high cost of high-voltage cables, the construction of fast charging stations requires 74 times more investment per station than that of AC charging stations.

The international trade environment has made matters worse. The United States imposed a 25% tariff on Chinese electric vehicle cables, forcing companies to restructure the global supply chain. Some companies have adopted the strategy of “Assembly in Southeast Asia + Localized Production” to deal with it, such as Jiangsu Hengtong setting up a production base in Vietnam to circumvent trade barriers.

Wireless charging technology poses a potential threat. BMW, Mercedes-Benz and other car companies have launched in-vehicle wireless charging systems. If the technology matures and is applied on a large scale, it will directly impact the charging cable market. Traditional cable companies need to find new positioning in technology iteration.

Environmental protection and standards: dual-track challenges of sustainable development

The new EU battery regulations and China’s “dual carbon” policy impose strict requirements on the entire life cycle of cables. Cables for new energy vehicles must meet the following requirements:

- Flame retardant and halogen-free: low smoke and non-toxicity when burning

- Recyclable design: improved convenience of material sorting

- Carbon footprint traceability: full monitoring from raw materials to production

The environmentally friendly products developed by East China Cable have achieved continuous fire for 3 hours without breakdown, meeting strict safety standards. However, the industry as a whole is still insufficient in the construction of a recycling technology system.

Inconsistent standards have become a development bottleneck. Differences in international standards for charging interfaces have led to fragmentation of cable specifications, with Tesla NACS, European CCS, and Chinese GB/T systems coexisting. The International Electrotechnical Commission (IEC) is promoting the standardization of vehicle-to-grid (V2G) bidirectional charging cables, and Phoenix Automotive has cooperated with Fermata Energy to achieve V2G function integration.

Corporate strategic breakthrough: technology + globalization dual-wheel drive

Facing opportunities and challenges, leading companies have multi-dimensional layout:

Technology research and development

- TE Connectivity develops 48V system connectors to reduce high-voltage system costs

- ABB launches Terra 360 charger to achieve simultaneous fast charging of four vehicles

- Far East Cable invests in the research and development of nano-modified insulation materials to improve corona resistance

Industry chain integration

- Baosheng shares extends upstream to control copper rod processing capacity to stabilize raw material fluctuations

- Wanma shares establishes a “cable + charging pile” service closed loop

International market development

- Zhongtian Technology sets up a research and development center in Germany to adapt to European automotive standards

- Leoni Group obtains exclusive supply qualifications for North American commercial vehicle high-voltage cables

Small and medium-sized enterprises focus on niche markets, such as Dongguan Jianhong focusing on the development of high-temperature resistant silicone rubber formulas and establishing advantages in the subdivision of special insulation materials.

The transformation of the cable industry reflects a deeper industrial logic: when China’s new energy vehicle production exceeds 20 million, when the global charging cable market rushes to 14.15 billion US dollars, when high-voltage cables transmit 600V high-voltage current between batteries and motors, this energy revolution is reshaping the genes of the cable industry.

Cable companies are facing not only breakthroughs in material science, but also the difficult transition from labor-intensive to technology-intensive. Those companies that have established technical barriers in the field of special cables and those that have successfully achieved the three-step jump of “material innovation-process upgrade-standard leadership” will eventually occupy a core position in the power transmission map of the new energy era.

This seemingly ordinary cable is flowing with the blood of the new energy era.